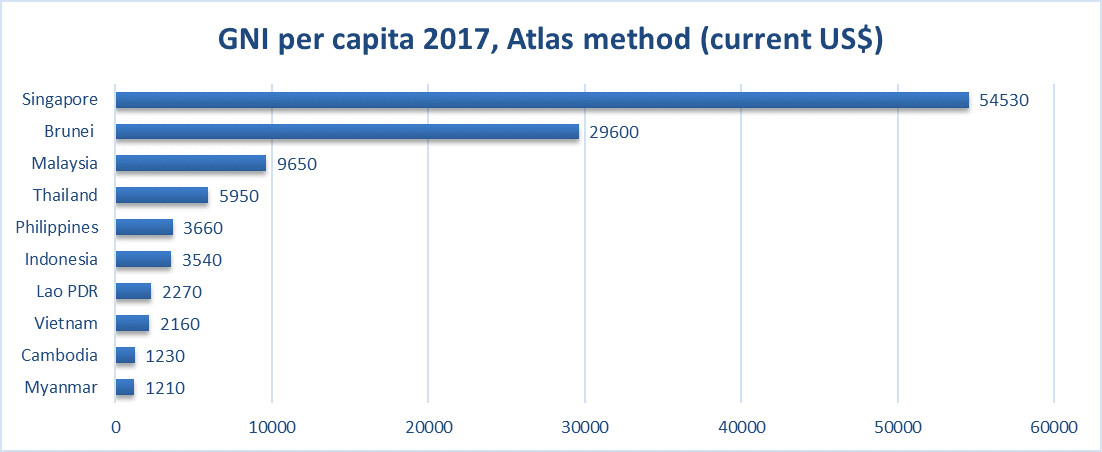

Looking at the world economy through the lenses of the Gross National Income (GNI) per-capita it is possible to identify four categories. The first one encompasses low-income countries,[1] below USD995 GNI per capita, still affected by the poverty trap. The second group comprises countries which attained middle-income level (between USD996 and USD12.055 GNI per capita) long time ago,[2] but then they were not able to keep on growing. Many examples for this category are in Latin America. The third group consists of countries which have recently came to or are approaching the middle-income level. Several economies of the Association of the Southeast Asian Nations (ASEAN) and China are included in this group. The last category is composed of high-income countries, with a GNI per capita above USD12.056, such as the members of the Organisation for Economic Co-operation and Development (OECD).

The key economic challenge for most countries in group 2 is how to avoid the so called ‘middle-income trap’ (MIT)[3] and advance to a high-income level. Starting from a brief analysis of the growth trajectories of ASEAN economies, the article aims to answer this question exploring the determinants of the ‘trap’ and discussing policies proved successful in other countries to avoid or escape stagnation after reaching middle income level.

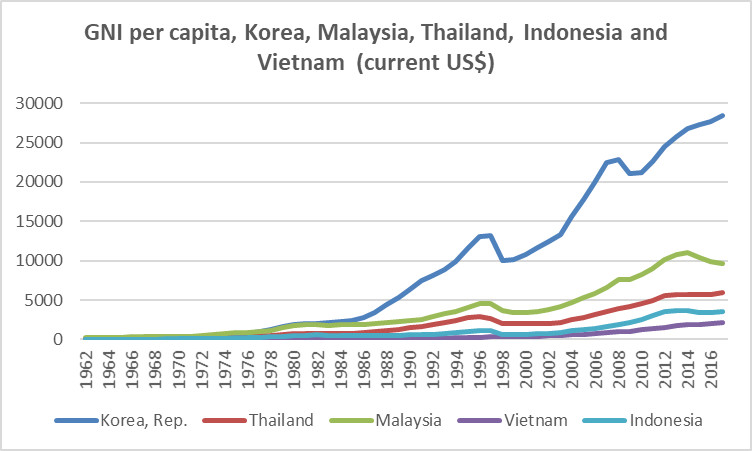

Source: World Bank, World Development Indicator (WDI)

ASEAN economic growth

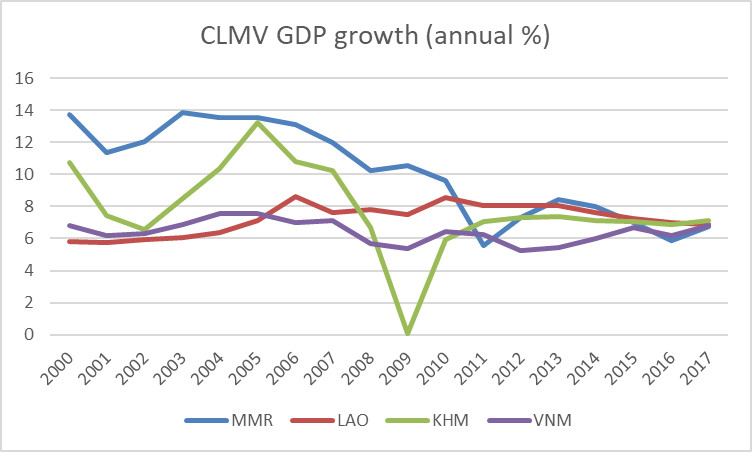

Located at the center of the most dynamic economic area in the world – the Indo-Pacific region – ASEAN keep on showing a good economic performance. The average annual GDP of its members grew at 5.3% in the period 2000-2017. Some countries did better than others. In particular, the new members of ASEAN, i.e. Cambodia, Laos, Myanmar and Viet Nam (CLMV), at a low middle income level (GNI per capita USD996-3895) have been growing faster reducing per capita income gaps with other member countries.

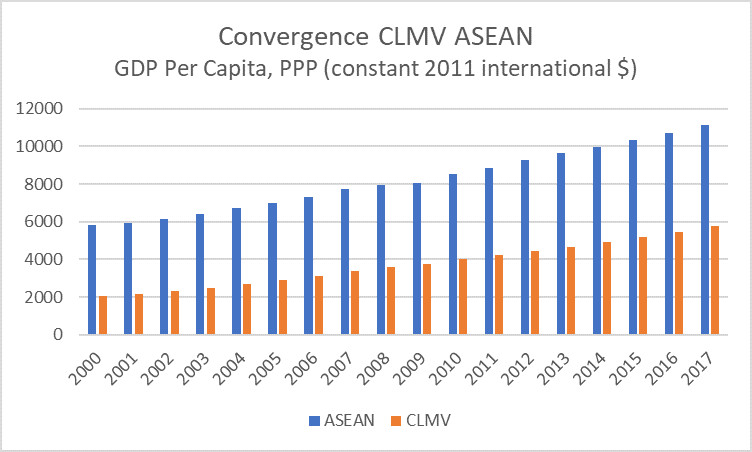

Source: World Bank, WDI

The average Gross Domestic Product (GDP) per capita in ASEAN moved from being nearly three times that of CLMV in 2000 to less than two times in 2017 when calculated in Purchasing Power Parity (PPP). The rapid growth of CLMV has also been associated with dramatic reductions in poverty. Notwithstanding these achievements, different kinds of intra-country inequities remain high or have increased, including across rural and urban areas or center and periphery, along ethnic and religious lines, and between genders. As a result, polarization, both economic and social, is increasing. These factors can threaten cohesion and pose major risks to social stability, and growth itself, as well as the poverty elasticity of growth.[4] An even bigger threat to CLMV growing potential is MIT that will be analysed in the following paragraphs.

Source: World Bank, WDI, (based on author’s elaboration)

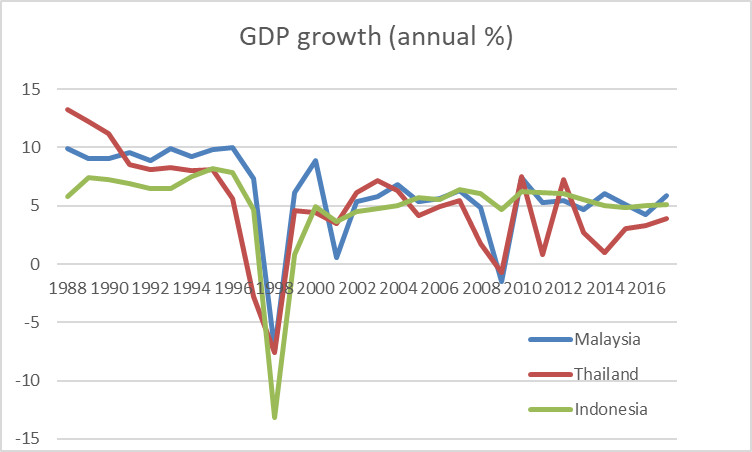

ASEAN founding members, with the notable exception of the Philippines, performed better in the last decades of the 20th century. Thailand GDP growth was above 10% in the period 1987-1997,[5] then abruptly plummeted during the Asian crises and never reached again the same performance. The average GDP growth in the last 15 years was around 4%. Malaysia and Indonesia followed a similar path. All three countries are currently struggling to escape MIT and testing policies to regain strong growing momentum. Looking at the per capita GNI of upper middle-income ASEAN countries relative to the U.S. level,[6] Malaysia and Thailand rapidly caught up with the U.S. during 1985-1997, but the catching-up was much less impressive in 1998-2008. The recent performance of Indonesia has also been poorer than in preceding periods.

Source: World Bank, WDI

The Philippines did not share the same economic path with the previous three ASEAN founders. In the 1990s, during the roaring years of Thailand and Malaysia, the archipelago was considered as the ‘sick man of Asia’,[7] while in the last five years its macroeconomic performance improved significantly with an annual GDP growth close to 7%.[8] To certain extent its growing trajectory is closer to the CLMV one showing a better performance in recent years than the last decades of the 20th century. Singapore, another founding member of ASEAN, is an out layer. It was able to continue its remarkable growing trajectory avoiding the MIT and reaching high-income level already in 1991. Recently it became one of the richest countries in the world with a GNI per capita over USD54.000 (2017).[9] Brunei reached high-income level in 1989 and a GNI per capita close to USD30.000 in 2017. Overall, despite the good economic performance, most ASEAN members, except for Singapore and Brunei, find themselves trapped or at risk of being trapped in a scheme in which growth based on low cost comparative advantage is reduced as incomes grow.

The middle-income trap and its determinants

A growing body of economic literature has focused on the MIT,[10] different definitions have been proposed, and the phenomenon has been analysed from different perspective.[11] Some scholars even challenged the very existence of MIT[12] arguing that it is possible to identify development traps at all level of income. Gill and Kharas first used the term MIT,[13] in 2007, referring to countries squeezed between the low wage poor-country competitors that dominate in mature industries and the rich-country innovators that dominate in industries undergoing rapid technological change. In the words of the Asian Development Bank (ADB), MIT is a situation where a middle-income country can no longer compete internationally in standardised, labor-intensive goods because wages are relatively too high, but it is also not ready to compete in higher value-added activities due to relatively low productivity.[14] The phenomenon happens when wages in a country rise to the point that growth potential in export-driven low-skill manufacturing is exhausted before it attains the innovative capability needed to boost productivity.

More in detail, the process of getting stuck in MIT[15] can be explained with the following steps. As economies move from low- to middle-income status, they can compete internationally by moving from agricultural to labor-intensive, low-cost manufactured products. Using imported technologies, late-developing economies reap productivity gains as workers shift from the agricultural sector to the manufacturing sector. Eventually, the pool of transferrable unskilled labor is exhausted, or the expansion of labor-absorbing activities peaks. As countries reach middle-income levels, real wages in urban manufacturing rise or market share is lost, and gains from importing foreign technology diminish. The emergence of a ‘Lewis Turning Point’ – with wages rising faster than the rate of inflation – often signals a coming MIT. The result is slow growth, stagnant or falling wages, and a growing informal economy.

Most empirical studies on MIT shows how developing countries face a declining productivity growth and struggle to boost total factor productivity (TFP) when they reach middle-income level.[16] TFP refers to the efficiency with which capital and labor are combined to produce added value.[17] TFP reflects the development of production, process technologies and ideas. It represents the residual growth once the specific contribution of capital and labor have been identified. In the literature on MIT, TFP is regarded as one of the most significant elements for economic growth. Eichengreen, Park, and Shin found that, on average, the decrease in TFP growth rate explains around 85% of the growth slowdown in their sample of countries trapped at the middle-income level, while the decreases in labor and capital growth only play a small role.[18]

TFP growth, in turn, can be explained by a host of factors. A recent regression run by ADB identified human capital and R&D as the most important determinants of TFP growth.[19] Low levels of human capital stock limit growth opportunities for companies and correspondingly can slow down economic development thereby endangering a country competitiveness. Skill gaps affect further development as a domestic supply-side constraint, but also deterring foreign investment and technological upgrading by firms.[20] Various externalities determine underinvestment in human capital and a consequent persistence of skill gaps ultimately trapping countries. Efforts to strengthen R&D activities[21] and quality of human resources are essential for facilitating the transition from a labor-surplus to a labor-shortage economy, the transition from input-driven growth to TFP-based growth, and for upgrading the industrial and export structure to high-skill and technology-intensive products.

Other studies stress the role of institutions, infrastructure, macroeconomic fundamentals, demographics, level of economic diversification and trade structure on TFP growth. Rodrik emphasises the role of high-quality institutions including: good governance; corporate governance; wide participation of various stakeholders in the policy decision process; effective cooperation among academics, businesses, and government in the formation of strategy for strengthening international competitiveness; efficient and transparent relationship between government and businesses; and increasing investment in R&D. Rodrik also emphasises the need of qualified bureaucrats and a strong private sector for building high-quality institutions, which are also necessary for the improvement of human capital over time and the upgrade of industrial structure toward skill-intensiveness. Infrastructure play a role per se on TFP growth, but it is also instrumental to boost human capital. Telecommunications for example are paramount to develop a knowledge economy.[22]

Paus highlighted the role of global context and inequality on MIT.[23] The rise of China compounded with an increasing competitive pressure and speed of technological change has changed the global architecture of production. Such a dramatic change made it more challenging for a middle-income country with limited innovation capabilities to increase TFP, overcome MIT and catch up with high income countries. Internally, high income inequality may lead to unequal access to education which, in turn, limits the accumulation of the human capital needed for innovation. Moreover, high inequality may result into political instability making difficult to implement any long-term development strategy.

Among other determinants of MIT should also be included the rigidity of a country to change growth patterns, having lost their competitive advantage such as from low manufacturing labor costs in the case of some ASEAN countries. More broadly, the ability to formulate and implement new policies consistent with the evolving challenges of a country moving from one income status to the next influences significantly the chances to avoid or overcome MIT.

Escaping the middle-income trap

According to the ‘Growth Report’ by the Growth Commission, only 13 countries were able to escape MIT since the 60’s, and five of them are in East Asia – Japan, Korea, Hong Kong, Taiwan and Singapore.[24] The experience of some of these countries can support the reflection within ASEAN on how to address ongoing MIT or the risk to be trapped.

A first key factor underlying the success of the East Asian economies that were able to transition from middle to high-income status was their ability to push the technological frontier and move from imitating and importing foreign technologies to innovating technologies of their own. The creation of a large framework for innovation based on technological learning, public sector support of R&D investments and strong intellectual property rights protections have been a major factor in facilitating this homebased innovation. Conversely, the ASEAN countries at middle-income level tend to just import foreign technologies and the level of investment in R&D as a percentage of GDP is still very low. Malaysia figure was the highest among these countries, but it was only 1% in 2012, compared with 4% for Korea in the same year and 2.27% ten years earlier.[25] The performance of R&D activities has been partly reflected in the number of patents granted. As expected, the gap between the current situation of ASEAN and that of Korea in the 1980s is large. The average annual number of patents granted to Korea in the 1980’s and 1990’s was around 8,000, while the current average in ASEAN is less then 1,000.[26]

The results of R&D activities have to be commercialised through product and process innovation employing high-quality human resources, in particular tertiary graduates with strong industrial technical skills and background in engineering. The current situation of ASEAN middle-income economies is different from the case of Korea in the 1980s and 1990s. First, the current average enrolment rate of ASEAN middle-income countries is below 50%, while Korea reached this level already in 1996 and was above 70% in 1999. Second, and more importantly, in Thailand, the Philippines, and Indonesia, graduates in industry fields such as engineering, manufacturing, and construction accounted for only approximately 10% of all graduates,[27] while the share of social sciences in total graduates was as high as about 40%. In contrast, the situation in Korea in 1999 was reversed.

Another interesting lesson for Korea comes from the public private coordination in supporting innovation. Korean firms, including small and medium-sized enterprises (SMEs) have emphasized the development of technology and R&D activities since the early 1980s.[28] This positive behavior of private firms has been enhanced by government policy. The Government of the Republic of Korea has supported private R&D by giving tax credits, allowing accelerated depreciation, and lowering import tariffs. R&D activities have been directly conducted by the government since the mid-1960s. However, since the early 1980s the emphasis has gradually shifted to the private sector and the role of government has been to provide incentives through fiscal and trade policies.

With a significant R&D effort and high quality of human resources, ASEAN middle-income economies can be expected to upgrade their industrial structure to high skill-intensive products and improve over time their competitiveness in international markets.

Other important lessons learnt concern infrastructures, labor market and trade. All East Asian economies that were able to escape the middle-income trap succeeded in developing advanced infrastructure networks, particularly in the form of high-speed communications and broadband technology. Thanks to the liberalisation of telecommunications networks and related regulatory framework reforms, a number of countries in the region have been able to develop and enhance the availability of information and communications services.[29]

Flexible labor markets and open economic policies have allowed for the reallocation of labor across sectors within the most successful economies in the region. Countries in the region have relied extensively on international trade to accelerate their labor transfer by inserting themselves into the labor-intensive segments of global value chains. Such a transfer was facilitated by advances in ICTs and by decreasing transport costs and lowering international trade barriers.[30] This labor market flexibility has facilitated the new labor transition, now increasingly toward innovative occupations.

Source: World Bank, World Development Indicator

Finally, escaping MIT requires an effective policy-making cycle able to transform in reality the ideas previously discussed. Few key principles should be understood, interiorized and nurtured at all different layers of the government and other stakeholders involved in economic reforms. First, policy formulation and implementation should not be handled separately. They are part of the same process. Therefore, the policy formulation cannot be left only to the ministers and few international consultants. Representative of all stakeholders involved in a new policy implementation should participate since its inception. Second, policy making exercises aimed at addressing MIT should be problem-driven and based on a mechanism of trial and errors. Third, while it is easy to find best practices that worked well in other countries at other times, a copy paste process would inevitably fail in addressing the specific evolving economic complexity of a country facing MIT today or tomorrow. The experience of other countries is there only to inspire policy makers in finding their own solutions which should be fully customized to their specific country and current global context. Similarly, it is important avoiding the temptation to create institutions that just mimic the form of performing ones without developing the actual operational functions.

Conclusion

Determinants of growth at low and high income levels may be different. If countries struggle to transition from growth strategies that are effective at low income levels to those effective at high income levels, they may stagnate at some middle income level.

MIT has become the great concern of ASEAN, but it is not unavoidable. Examples of East Asian economies that were able to transition from middle-income status to high-income status based on their ability to increase total factor productivity are there to prove it, but they cannot be simply copied. What is needed is a timely shift of policy focus and an effective policy-making cycle. Governments should act early, not when the benefits of cheap labor and the gains from imitating foreign technology are already exhausted. The government strategy should be based on timely implementation of public policies aimed at improving access to advanced infrastructure, enhancing the protection of property rights, and reforming labor markets. These policies are central to fostering technological learning, attracting talented individuals into R&D activities, and encouraging the creation of national and international knowledge networks.

While the problem for high middle-income countries such as Malaysia and Thailand is in promoting innovation-oriented policy to maintain international competitiveness to avoid the trap, the problem for the low middle-income countries such as Viet Nam, Laos, Myanmar and Cambodia is strengthening basic infrastructure and institutions, promoting market and private sector development and ensuring equal competition among economic actors for efficient use of capital, land, and other resources. However, all ASEAN countries should not only stride to identify ‘what to do’ to address MIT, but also consider carefully ‘how’ to formulate and implement their new policies and check the health their policy-making cycle. Ministries’ desks of stagnating economies are full of wonderful policies not implemented.

[1] World Bank Country and Lending Group, available online at <https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups>.

[2] More than 50 years ago in many cases

[3] Tran, V.T. (2013) ‘The Middle-Income Trap: Issues for Members of the Association of Southeast Asian Nations’, ADBI Working Paper 421, Tokyo: ADBI, available online at <http://www.adbi.org/working-paper/2013/05/16/5667.middle.income.trap.issues.asean/>.

[4] Menon, J. (2012) ‘Narrowing the Development Divide in ASEAN: The Role of Policy’, ADBI Working Paper 100, Tokyo: ADBI, available online at <https://www.adb.org/sites/default/files/publication/30403/reiwp-100.pdf>.

[5] See Databank World Bank, available online at < https://data.worldbank.org/>.

[6] Tran, V.T. (2013) ‘The Middle-Income Trap’, quoted.

[7] Press statement of Motoo Konishi, Co-Chair Philippines Development Forum, Davao City, 6 February 2013, available online at < http://www.worldbank.org/en/news/speech/2013/02/06/Press-Statement>.

[8] Philippines, DataBank, available online at <https://data.worldbank.org/country/philippines>.

[9] Singapore, DataBank, available online at <https://data.worldbank.org/country/singapore>.

[10] Glawe, L., Wagner H. (2016), ‘The Middle-Income Trap – Definitions, Theories and Countries Concerned: A Literature Survey’, Munich Personal RePEc Archive (MPRA), Paper No. 71196, available online at <https://mpra.ub.uni-muenchen.de/71196/>.

[11] Paus, E. (2014) ‘Latin America and the Middle-Income Trap’, ECLAC, Financing for Development Series, No. 250, available online at <https://ssrn.com/abstract=2473823>.

[12] Bulman D., Eden M., Nguyen H. (2017) ‘Transitioning from Low-Income Growth to High-Income Growth: Is There a Middle-Income Trap?, Journal of the Asia Pacific Economy, Vol. 22(1), pp. 5-28.

[13] Gill, I., Kharas H., (2007) An East Asian Renaissance: Ideas for Economic Growth, Washington D.C.: The International Bank for Reconstruction and Development.

[14] Paus, E. (2017) ‘Escaping the Middle-Income Trap: Innovate or Perish’, ADBI Working Paper 685, Tokyo: ADBI, available online at <https://www.adb.org/sites/default/files/publication/231951/adbi-wp685.pdf>.

[15] Agénor P.R., Canuto O., Jelenic M. (2012) ‘Avoiding Middle-Income Growth Traps’, PREM Network No. 98, available online at < http://siteresources.worldbank.org/EXTPREMNET/Resources/EP98.pdf>.

[16] Kim, J., Park J. (2017) ‘The Role of Total Factor Productivity Growth in Middle-Income Countries’, ADBI Economics Working Paper Series 527, Tokyo: ADBI, available online at <https://www.adb.org/sites/default/files/publication/383176/ewp-527.pdf>.

[17] ‘Beyond the Middle-Income Trap’, Transition Report 2017-2018.

[18] Eichengreen B., Park D., Shin K. (2012) ‘When Fast-Growing Economies Slow Down: International Evidence and Implications for China’, Asian Economic Papers, MIT Press, Vol. 11(1), pp. 42-87, available online at <https://www.nber.org/papers/w16919.pdf>.

[19] Kim, J., Park J. (2017) ‘The Role of Total Factor…’, quoted.

[20] Saner R., You L., Gopinathan S. (2014) ‘Policy Debate. Learning to Grow Beyond the Middle-Income Trap – Singapore as an Export Model?’, International Development Policy | Revue internationale de politique de développement, available online at <http://journals.openedition.org/poldev/1803>.

[21] Tran, V.T. (2013) ‘The Middle-Income Trap’, quoted.

[22] Rodrick D., (2007) One Economics, Many Recipes. Globalization, Institutions, and Economic Growth, Princeton and Oxford: Princeton University Press.

[23] Paus, E. (2017) ‘Escaping the Middle-Income Trap’, quoted.

[24] Commission on Growth and Development (2008), The Growth Report. Strategies for Sustained Growth and Inclusive Development, Washington D.C.: The International Bank for Reconstrution and Development,

[25] See World Bank Open Data.

[26] See data provided by World Intellectual Property Organisation at <https://www.wipo.int/edocs/pubdocs/en/wipo_pub_941_2017-chapter2.pdf>.

[27] Tran, V.T. (2013) ‘The Middle-Income Trap’, quoted.

[28] Ibid.

[29] Gill, I., Kharas H., (2007) An East Asian Renaissance, quoted.

[30] Agénor P.R., Canuto O., Jelenic M. (2012) ‘Avoiding Middle-Income Growth…’, quoted.

Rientrato dai mesi trascorsi in Cina come primo titolare della Agnelli Chair of Italian Culture presso la Peking University, Romano Prodi ha parlato a lungo... Read More

Sin dall’insediamento in carica dell’attuale Primo Ministro Anwar Ibrahim nel novembre 2022, la Malaysia ha vissuto una fase politica inedita e, per molti versi,... Read More

“Beijing is trying to stabilize the relations with Washington to buy some time to further increase its tech and economic self-sufficiency. That’s more important... Read More

“Other than condemning the US strikes on Iran, Beijing can be expected to continue treading cautiously in the Middle East’s security issues and would... Read More

“They thought Trump 2.0 was going to be more transactional, possibly more pragmatic, so maybe a more stable relationship. It is not turning out... Read More

Copyright © 2025. Torino World Affairs Institute All rights reserved